常用单词词根记忆法(词根速记单词DAY98-verb-)

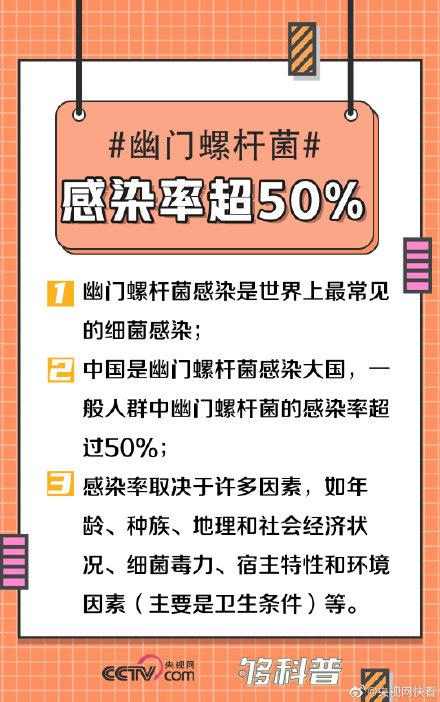

-verb- 字,词

verb [vɜːb] n. 动词;动词词性;动词性短语或从句 adj. 动词的;有动词性质的;起动词作用的

拆分:verb 词根直接表单词 → 动词

例句:

How does this verb conjugate?

这个动词有哪些词形变化?

拓展:

verbal ['vɜːb(ə)l] adj. 口头的;言语的;动词的;照字面的 n. 动词的非谓语形式

verbally ['vɝbli] adv. 口头地,非书面地;用言辞地

nonverbal [nɒn'vɜːbəl] adj. 不用语言的;不用动词的

nonverbally [nɒn'vɜːbəli] adv. 非动词(形式)地

proverb ['prɒvɜːb] n. 谚语,格言;众所周知的人或事

拆分:pro- 提前 -verb 字/词 → 提前写好的东西,大家都知道 → 格言/谚语

例句:

An old Arab proverb says, "The enemy of my enemy is my friend." 有一句古老的阿拉伯谚语说:“我敌人的敌人是我的朋友。”

拓展:

proverbial [prə'vɜːbɪəl] adj. 谚语的;众所周知的;谚语式的

proverbially [prə'vɝbɪəli] adv. 人尽皆知地

adverb ['ædvɜːb] n. 副词 adj. 副词的

拆分:ad- 趋近 -verb 动词 → 趋近动词的 → 修饰动词的词 → 副词

例句:

In 'speak quietly', the adverb 'quietly' is a modifier.

在speak quietly中,副词quietly是修饰语。

拓展:

adverbial [əd'vɜːbɪəl] adj. 状语的;副词的 n. 状语

verbatim [vɜː'beɪtɪm] adv. 逐字地 adj. 逐字的

verbalize ['vɜːb(ə)laɪz] vi. 累赘;唠叨;以言语表述

verbalized ['vɜːb(ə)laɪzd] v. 描述;使变成动词;语言化

verbalization [,vɝbəlɪ'zeʃən] n. 以言语表现;冗长;变成动词

-di- = day 日

diet ['daɪət] n. 饮食;食物;规定饮食 vi. 节食 vt. [医] 照规定饮食

拆分:di- 日 -et 额度 → 每天的额度 → 饮食额度 → 规定饮食 → 节食

例句:

It's never too late to improve your diet. 改善饮食什么时候都不嫌晚。

拓展:

dieting ['daiətiŋ] n. 节食;节食减肥 v. 给…规定饮食;喂食

dieter ['daɪətə] n. 节食者

dietary ['daɪət(ə)rɪ] n. 规定的食物;饮食的规定;食谱 adj. 饮食的,饭食的,规定食物的

dietetic [,daɪə'tetɪk] adj. 饮食的;饮食学的

dietetics [daɪə'tetɪks] n. 营养学;饮食学

dietitian [daɪə'tɪʃ(ə)n] n. (美)营养学家;饮食学家

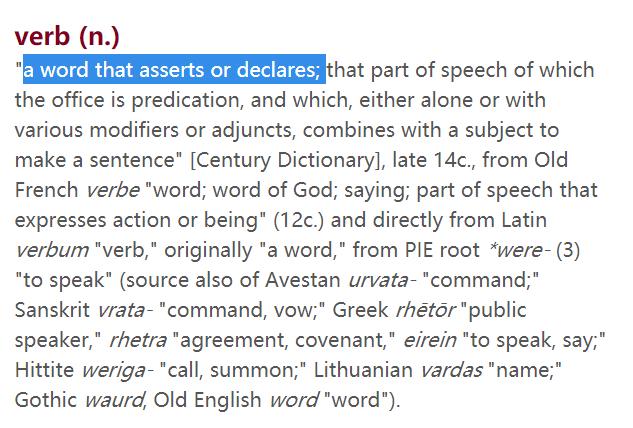

diary ['daɪərɪ] n. 日志,日记;日记簿

拆分:di- 日 -ary 名词后缀 → 每天的东西 → 日记

例句:

I had earlier read the entry from Harold Nicholson's diary for July 10, 1940. 我早就在哈罗德·尼科尔森1940年7月10日的日记里读到过那则记录。

拓展:

diarist ['daɪərɪst] n. 日记作者;记日记者

diarize ['daiəraiz] vt. 记日记

diarial [dai'εəriəl] adj. 日记体的,日记的

dial ['daiəl] n. 转盘;刻度盘;钟面 vi. 拨号 vt. 给…拨号打电话

拆分:di- 日 -al 形容词后缀 → 记录时间的工具 → 日晷 → 转盘

例句:

The luminous dial on the clock showed five minutes to seven. 发光的表盘上显示6:55。

拓展:

dialing ['daiəliŋ] n. 拨号,主叫 v. 拨(电话号码)

redial [,ri'daɪl] n. 重拨 vi. 重新拨号 vt. 重拨

meridian [mə'ridiən] adj. 子午线的;最高点的

-rar- 稀有

rare [reə] adj. 稀有的;稀薄的;半熟的 adj. 杰出的;极度的;非常好的 adv. 非常;极其vi. 用后腿站起;渴望

拆分:词根直接表单词 → 稀有的/杰出的

例句:

Both countries are behaving with rare delicacy.

两个国家都表现出难得的体谅周到。

拓展:

rarely ['reəlɪ] adv. 很少地;难得;罕有地

rarity ['reərɪtɪ] n. 罕见;珍贵;珍品(需用复数);稀薄

rarify ['rεərifai] vt. 使成精细;使变稀薄 vi. 变稀薄;纯化

rarified ['rεərifaid] adj. 纯净的;稀薄的 v. 使变稀薄

rarefy ['reərɪfaɪ] vt. 使纯化;变稀薄;精选 vi. 变稀薄;纯化

rarefied ['rεərifaid] adj. 稀薄的;纯化的

参考资源:

《三万八词汇——宋维刚》、《词根词缀词典》、《有道词典》

背单词真理:

不断重复大量单词,直到熟悉每个词。坚持是最重要的!

词根背单词:

适合于有一定英语基础的人,按照含有相同关键词根的词汇顺序去记忆单词,会比杂乱无章更有效果,适合各种考试党(中考、高考、考研、雅思、托福等)和上班族(相关专业词汇就得要靠平时重复积累咯)。

词汇专题:

每天在公众号分享一个词根,偶尔断更请原谅哈!每天接触新的单词,同时复习旧的,放在公众号上,方便自己记忆。

今日份学习结束,你记住了吗(*^__^*)

前期回顾:词根速记单词DAY97:-frequ 频繁的

外刊文章分享:

IN JUST TWO months the world economy has been turned upside down. Stockmarkets have collapsed by a third and in many countries factories, airports, offices, schools and shops have been closed to try to contain the virus. Workers are worried about their jobs and investors fear companies will default on their debts. All this points to one of the sharpest economic contractions in modern times. China’s GDP probably shrank by 10-20% in January and February compared with a year earlier. For as long as the virus rages, similar drops are likely in America and Europe, which could trigger a further downward lurch in Asia. Massive government intervention is required to ensure that this shock does not spiral into a depression. But scale alone is not good enough—new financial tools need to be deployed, and fast.

Western authorities have already promised huge sums. A crude estimate for America, Germany, Britain, France and Italy, including spending pledges, tax cuts, central-bank cash injections and loan guarantees, amounts to $7.4trn, or 23% of their GDP (see Briefing). Yet central banks are responsible for over four-fifths of that and many governments are doing too little. A huge array of policies is on offer, from holidays on mortgage-payments to bail-outs of Paris cafés. Meanwhile, orthodox stimulus tools may not work well. Interest rates in the rich world are near zero, depriving central banks of their main lever. Governments typically try to stimulate demand in a downturn but people trapped at home cannot spend freely. History is not much of a guide. The global pandemic of 1918 took place when the economy was wrecked by war. China has endured a lockdown but its social model is different from the West’s.

What to do? An economic plan needs to target two groups: households and companies. And it needs to be fast, efficient and flexible so that if the virus retreats only to resurge, workers and firms can be confident that governments will dial assistance down and up again as needed. Start with households, where large government spending is needed. One aim is to protect vulnerable people, by subsidising sick pay and ensuring those without insurance have health care. But spending is also needed to discourage lay-offs at firms running far below capacity, by subsidising workers’ wages—an area where Germany has led the way.

Governments also need to jerry-rig digital systems so they are able to distribute cash to households directly, as Hong Kong hopes to. The aim should be to have the capability to ramp further support up and down quickly. Many places, including America, rely on sluggish postal services and tax agencies to distribute cash. If funds can be sent instantly through mobile phones or online bank accounts, people will feel more confident and avoid hoarding cash and slowing the recovery when the virus recedes.

All this spending will cost governments dear, but the fiscal stimulus of about 1% of GDP so far across Europe is clearly too low. America’s plan to spend 5% is closer to the mark given the risk of a double-digit GDP drop. As fiscal deficits balloon, governments will have to issue piles of bonds. Central banks should step in to buy those bonds in order to keep yields low and markets orderly. Inflation is a second-order concern and there is little danger of it taking off. To prevent a euro-zone crisis, the European Central Bank plans to buy €750bn of assets. But it and European governments should also give a clear guarantee of sovereign support for Italy and other peripheral economies.

The second priority is to get cash to millions of companies, whose failure would damage the economy’s potential. They face a cash drought even as bills fall due. Bond markets are closed to many of them. Mass defaults would fuel unemployment and bad debts at banks, and make it harder for commercial activity to rebound. Most governments have intervened, but in flawed ways. France says nationalisation is an option—which firms will resist. America is propping up the commercial-paper market, but this funds only a fraction of all corporate debt and is used by big firms—not small ones, which employ most people. Germany and Britain have offered loan-guarantee schemes but it is unclear who will process millions of loan applications. The best approach is to use the banking system—almost all firms have accounts, and banks know how to issue loans. Governments should offer banks cheap funding to lend to their clients while guaranteeing that it will bear most of the losses. Borrowers could be offered bonuses for repaying loans early.

There are huge drawbacks to all of this. Public and corporate debt will soar. Handouts will be given to rich people and loans extended to firms that are badly run. But even with this fearful list of side-effects, the advantages are overwhelming. Cash will be distributed fast. Vulnerable people will be able to get by. Households will be confident enough to spend when conditions improve. And firms will keep their workforces and plants intact, ready to get back to action when this dark episode has passed.■

,免责声明:本文仅代表文章作者的个人观点,与本站无关。其原创性、真实性以及文中陈述文字和内容未经本站证实,对本文以及其中全部或者部分内容文字的真实性、完整性和原创性本站不作任何保证或承诺,请读者仅作参考,并自行核实相关内容。文章投诉邮箱:anhduc.ph@yahoo.com